Processor definition : responsibilities and role

Discover the definition of a FinTech payment processor

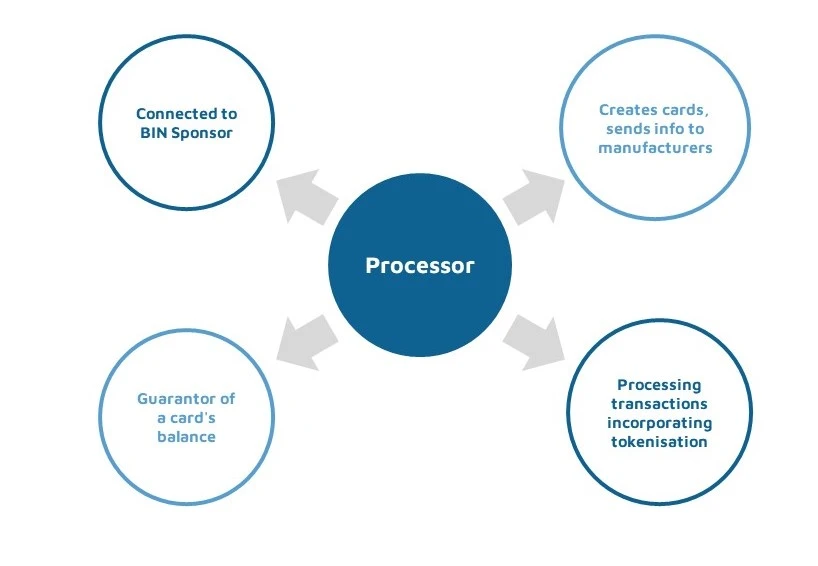

In the constantly evolving world of financial technology (FinTech), processors play a crucial role in simplifying transactions. Thanks to cutting-edge technology and expertise, the processors streamline payment procedures, guaranteeing efficiency and reliability while being connected to the BIN Sponsor. In this article, we’ll discover the definition of a processor in the FinTech industry, explore their responsibilities and highlight the importance of their role in the industry.

Definition of a FinTech processor

A processor in FinTech is a specialised entity that acts as a link between “shops”, financial institutions and payment networks. It enables transactions to be authorised, processed and settled, facilitating the transfer of money between buyers and sellers. The processors handle various payment mechanisms such as credit and debit cards, e-wallets and mobile payments. In other words, they are the ones who process the transactions and then decide whether or not to validate them.

Processor responsibilities

A processor’s main responsibility is to authorise transactions, facilitate the movement of funds and process transfers securely by verifying the validity of payment data. To do this, they use innovative encryption and fraud detection techniques to protect buyers’ and sellers’ private information from potential risks.

The importance of processors in FinTech

Processors play an essential role in the development of the FinTech industry. They offer “core processing services”, which include card account creation and activation, card transaction authorisation, card loading, and the detection and reporting of fraud and security incidents. They also provide customer assistance for cardholders and handle refund processing.

By collaborating with processors, companies can offer a variety of payment methods, boosting customer satisfaction and enabling them to expand in the market. What’s more, the processors guarantee compliance with industry regulations, enabling companies to concentrate on their core business while leaving payment management to the experts.

Would you like to find out more about our products?

What is the link between a Processor and a Programme Manager?

To benefit from the processor’s services, companies have to go through a Programme Manager. A Programme Manager is in charge of establishing relations between the processor and distributors. On the one hand, the processor acts as a hardware component, meticulously executing the instructions and calculations essential to the flawless processing of these financial transactions. The Programme Manager oversees the development and management of these FinTech software applications, ensuring that they fully meet the rigorous requirements of the financial institution.

As FinTech continues to reshape the financial landscape, a Programme Manager still plays an essential role in stimulating innovation and fostering trust in the FinTech ecosystem. At E-Pay Space, we ensure that our processor fully complies with the necessary security standards to optimise our services for our customers.

What is a Programme Manager?

E-Wallet

What is a BIN Sponsor?

Need help developing a payment solution?